Everybody Is Flipping Out, Man

by Brendan O’Connor

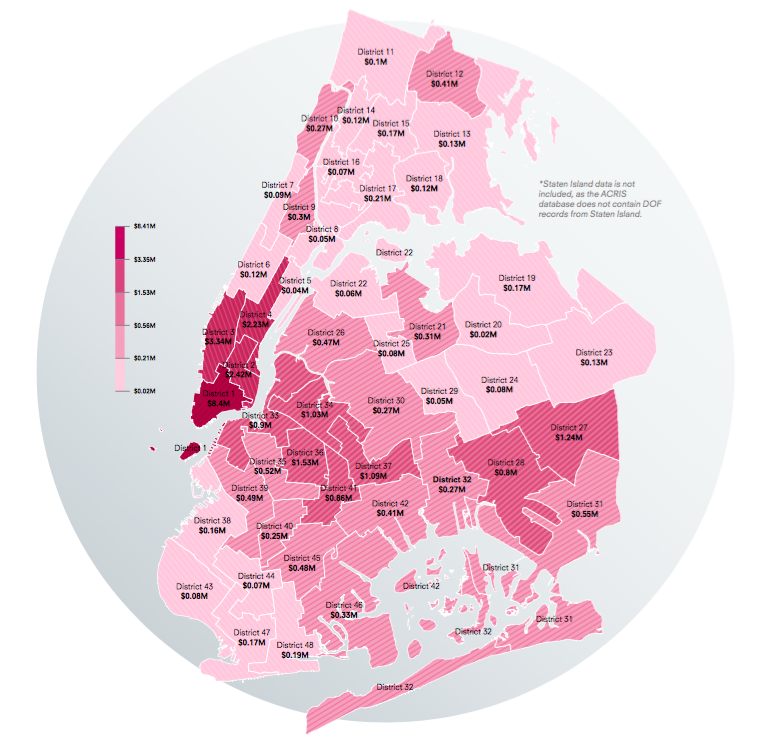

Distribution of a proposed one percent sales tax on flips in 2014

In real estate, “flipping” is the practice of buying a piece of property and then selling it a short time later, often having renovated, rehabilitated, or otherwise upgraded it to increase its value. Despite being a risky and expensive proposition, this kind of thingprac happens all over the country. According to real estate analytics firm RealtyTrac, nationally, the average return for investors on a house flip in the first quarter of 2015 was 35.1 percent, up from thirty-five percent at the same time last year; returns on flips in the New York and New Jersey metro area — where flips made up 3.7 percent of all sales — however, were even greater: investors saw an average return of 47.1 percent in the first quarter of this year.

New York City’s most successful flip last year, the Post reported in December, was a one-bedroom, one-bathroom apartment on the Upper West Side purchased for just under two hundred and seventy-five thousand dollars in February; it was resold in September for nearly eight hundred and ninety thousand dollars. “The best neighborhoods for profitable flipping are those that come with a higher risk because of location and condition of properties,” Ivona Perecman, a luxury broker and real estate attorney, wrote in her summary of RealtyTrac’s analysis. Flipping is, in a word, speculation.

Earlier this year, housing activists in Philadelphia issued a proposal arguing for an increased tax on sales of properties that had been bought within the previous two years. They found that there were, in 2013, more than six thousand such transactions, largely concentrated in that city’s gentrifying neighborhoods. According to their proposal, increasing the Realty Transfer Tax by 1.5 percent would generate nearly twelve million dollars every year, which could be directed toward building affordable housing. Inspired by this, Caroline Woolard, an artist and activist in New York, recruited a group of civic hackers, architects, and designers to develop what has become the Landscapes of Profit: A map showing where flipping takes place in New York and how much money people are making off of it.

Defining a flip as any transaction of a property owned for two years or less, Landscapes of Profit found that twenty-three billion dollars worth of flipped properties have sold in New York City in the last decade. In 2014, flippers sold 3.4 billion dollars worth of real estate; in 2015, flip sales reached 1.8 billion as of May. The project also includes a proposal that a one percent tax be imposed upon such sales: Such a tax, had it been in effect in 2014, would have generated 33.7 million dollars. This would, Woolard and her colleagues contend, be sufficient to pay for the construction of more than one hundred fifty units of affordable housing.

The information upon which the map is built comes from the New York City Department of Finance and the Department of City Planning public databases. (The finance department’s ACRIS website is a searchable record of all property sales in the city.) “Right now we’re just trying to show and educate people that we do have this blight, you could say, or epidemic — or, at least, increase — in flips,” Woolard told me over the phone. “At the very least what we’re doing is telling people that we could start to think about how development does not have to come with displacement — that the people who bring value to their neighborhoods should be compensated for the decades of work they’ve done, when some people come and leave, and make a significant profit. At the very least, we’re educating people, and at the very best, we move to modeling and get this into legislation.”

The most comprehensive visualization of the data Landscapes of Profit has accumulated thus far is visible at the Storefront for Art and Architecture, where, on one wall, an enormous map displays some of the most profitable flips from the past year, focussing on council districts in Brooklyn and Queens. The group is working on an interactive map that will be released online in the next few weeks, which will (ideally) allow users to zoom in on particular blocks to see what is going on in their neighborhood, as well as print drawings to send to council members. “Until you get street names, it’s still a little bit too abstract for most people,” Woolard said.

“Once we have that, and we can say, ‘Hey, look at these flipped properties near you.’ Everyone wants to know that, regardless of whether a one percent flip tax is implemented,” Woolard said. Even — or, perhaps, especially? — those who are looking to get into speculation in the first place. “We have to make it even more overt as propaganda, because it’d be easy to say, ‘Hey, look at how much money is made on flipping — why don’t I learn how to do that?’ So, we have to think through all the ways that it will be used and be ready to combat them, or be intelligent about how we inform people of the ramifications of their desire to make money.”

In New York City, the highest concentration of flips over the last decade took place in the city council districts comprising Lower Manhattan (District 1), Hell’s Kitchen and Chelsea (District 3), and the east side of Manhattan from the Upper East Side to Stuyvesant Town (District 4). A one percent tax on flips in District 1 would generate 8.4 million dollars; in District 3, 3.3 million dollars; in District 4, 2.2 million dollars. As expensive as Manhattan is, and as much revenue as flipping there can generate, the barrier to entry is high — inventory is also declining, having peaked in 2007. “This years-long deficit is unlikely to be corrected in a single year, leaving Manhattan homes in relatively short supply in 2015,” according to Streeteasy’s Trends & Data blog. “Across the East River in Brooklyn and Queens, however, inventory is poised to grow considerably. In 2014, the number of homes for sale in Brooklyn and Queens grew by 8.6 percent and 8.5 percent, respectively. We expect this growth to carry through in 2015. With buyers squeezed out of the Manhattan market, expect many of them to look eastward in 2015.” Last year, Council District 36, covering Bedford-Stuyvesant and northern Crown Heights, saw a hundred and fifty million dollars in flip sales, which would generate a 1.5 million dollars in tax revenue.

One of the troubles with a proposed one percent tax on flips is figuring out how to structure it in such a way that it doesn’t just create readily accessible loopholes — the most obvious one in Landscapes’ current proposal is that, if a “flip” is defined as a sale made within twenty four months of purchase, some people will just wait twenty five months before conducting their sale. “We could model that and see what people would tend to do, and then we would know exactly how much revenue we could expect,” Woolard said. “Because it’s not going to be applied retroactively. So we also have to give it teeth by knowing these kinds of properties would be likely to just pay the one percent rather than wait, and these properties would wait. Once we know that, we can actually go forward and talk to policy makers and legislators who know how to make policy that actually works.”

But policies that raise taxes on the wealthiest Americans — even in New York — that “actually work” are difficult to come by. There already exists a one percent tax, introduced in 1989 by then-Governor Mario Cuomo, on the sale of homes in New York over one million dollars — the so-called “mansion tax” — which, in the 2012–2013 fiscal year, generated two hundred and fifty-nine million dollars in revenue. (A Columbia study found last year that the tax created “a substantial bunching of transactions right below the $1 million level.”) In the spring, Mayor De Blasio proposed a new, additional one percent tax on the sale of homes between 1.75 million and five million dollars, as well as a 1.5 percent tax on sales greater than five million dollars. The tax would raise roughly two hundred million dollars per year in revenue that would be funnelled directly into affordable housing. The proposal, which became a bargaining chip in negotiations in Albany earlier this summer over tax breaks for developers, did not pass. (New York City’s taxes are determined by the state legislature.)

Meanwhile, a Supreme Court ruling in Maryland appears to have limited the city and state’s capacity to levy a proposed pied-a-terre tax on apartments valued at five million or more, owned by absentee landlords. A year and a half earlier, in a story about Australians investing in Bushwick (which saw a hundred and ten million dollars in flips in 2014), a Douglas Elliman broker told the Times, “I’d say by the spring, maybe 70 percent of the sales we were seeing were to hedge funds, investors and others taking advantage of what was happening in Brooklyn… Only about 30 percent were actual end users or first-time buyers.”