Haven on Earth: How Far Rich Folk (Like Mike Bloomberg) Will Go To Avoid Taxes

by Mark Bergen

Mike Bloomberg is an extremely generous rich man. Arianna Huffington dubbed him one of her “Game Changers” in giving, so you know it must be serious. With his $1 salary and relentless check-writing, the NYC Mayor is practically the Platonic ideal of a charitable tycoon: our Philanthropist-King.

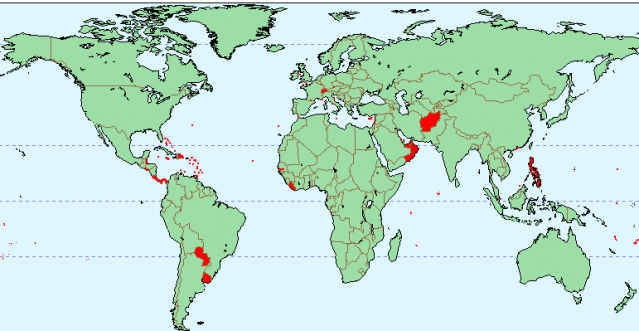

All that benevolence looked pretty petty, however, when news broke that his charity invested so as to keep tax payments out of the U.S. The New York Observer unearthed the documents that show how the Bloomberg Family Foundation’s money management team shuffled nearly $300 million into far-flung tax havens. The reporters smartly cull up a sarcastic quip from then-candidate Obama, pledging to tackle tax haven abuse head on. Too bad his tackle turned out to be just a light shove.

Sizable nonprofits like the Bloomberg Family Foundation that enjoy making sizable investments are subject to something called an Unrelated Business Income Tax. To sidestep tax, the Foundation allowed off-shore havens to make investments for them. Such a maneuver, an artfully vulgar Law professor told the Observer, “cleanses the unrelated business taint from the total return.”

All this taint-cleansing is perfectly legal. It’s just opaque and more than a little seedy. The delicious irony is that all this transpired while Bloomberg was forcefully condemning a statewide “Millionaire’s Tax.” It would, the Mayor said, in another iteration of his belief that various normal tases and costs are upsetting to rich corporations and people, spell the rapid exodus of richies and their tax dollars. All this concern occurred while Bloomberg stuffed $19.7 million alone into advantageous situations in his Bermudan home-away-from-home.

These revelations about Bloomberg only serve as a reminder of how serious financial reform can sputter, melt and just die.

For the incoming Changemaker-in-Chief, this was low-hanging fruit, a softball lob. Here was a clear example of corporate cruddiness as the country plummeted into economic recession. Stomping out tax havens plays to populist sentiment on the right and left, particularly as both sides trip over one another to pull up the covers and find the other canoodling in bed with those damn fat cats.

Last May, the new Administration trumpeted new reforms to overhaul the global machinery of tax evasion. Obama came out like a vigilant watchdog, promising to “detect and pursue” homegrown evaders. A package of enforcement measures, scheduled for 2011, would create hurdles for potential tax cheats and generate $43 billion over the next eight years, somehow. Even Treasury chief Tim Geithner, regarding whom there were concerns about his own tax flaws, supported the measure, chiding the loopholes that allow companies and “well-off citizens to evade the rules that the rest of America lives by.”

But then the molasses wheels of the legislative branch failed to to turn their spokes. Two month before Obama announced his plan, Senator Carl “Goldman Sacker” Levin introduced his Bill, aptly titled the “Stop Tax Haven Abuse Act.” It was full of measures to deter and restrict the use of, obtusely, “transactions involving offshore secrecy jurisdictions.” Co-sponsored by a measly five Senators (four Democrats, one indefatigable Democratic Socialist), the Bill was read twice (twice!) then sent to rest at the Committee on Finance.

A counterpart Bill in the House, introduced by a Democrat Texan named Lloyd Doggett, remains in a Subcommittee purgatory. In 2010, Wisconsin’s Russ Feingold wrote a Senate Bill about tax code revision with language on tax haven abuse buried inside. It does not a have single cosponsor.

Now, Congress has scores of excuses for not completing serious haven reform. There was the endless health care debate, immigration, climate change, Maryland basketball. Plus, they are taking on a commendable overhaul of the entire dysfunctional financial system. (And, by “they,” I mean the legislators who aren’t Senate Republicans, or named Ben.) But the 1336 page Senate Bill makes not one mention of tax havens.

A much more cynical explanation — and, probably, the depressing accurate one — rests at K Street. Six governments, home to the heftiest havens, dropped $2.3 million in lobbying fees, according to 2008 disclosures, to push their hundreds of contacts on Capitol Hill against tax haven reform.

The recent Jobs Bill, so says a tidbit buried in an AP report, will be paid in part by the tax haven crackdown. It’s a little unclear what this means. Marginal progress was made internationally when the Organization for Economic Cooperation and Development and the G20 summit agreed to ebb the $11.5 trillion flowing in havens internationally. But a recent report found this effort “lacking teeth.” Lobbying efforts from haven countries have defanged the crackdown, and Caribbean nations are crying fowl about double standards.

Perhaps reform efforts will be ignited as the U.S. Government starts to wrestle with the giant vampire squid. Add to their growing list of dubious (or at least offensive-looking) doings a plot to dupe foreign investors into buying mortgage-backed securities via a “shell company” in the Cayman Islands.

Bloomberg denied knowledge of the off-shore shuffling. While he has been in office, his investments are “blind” to him-though he does sign the overseas tax returns.

The Mayor once plugged a book called “Philanthrocapitalism,” a title that accurately describes his brand of high-profile altruism. Of course, the Mayor giveth, and surely it is within his rights to no longer giveth. In March, he quietly pulled his backing from a charitable enterprise that funds a huge number of the city’s arts and social services. This move would free up time to focus on his beloved Foundation “as he prepares to put greater emphasis on needs in the United States.”

Mark Bergen uses TurboTax.