Ask the Publisher: What the Hell With This Verizon/Aol Thing?

Verizon and Aol Why? What? Hmmm? These are just three of the many questions the world had about today’s $4.4 billion acquisition.

They were met with hundreds of responses. Given the subject matter — content blobs and ad tech — these responses were fuzzy and conflicting. Did Verizon just buy a bunch of blogs? The future of web advertising? A scam timeshare in content shitworld?

I asked Michael Macher, Awl Network publisher and advertising expert (I hope????), to explain.

John Herrman, Awl Content Producer: Publisher, why did this happen?

Michael Macher, Awl Content Monetizer: The answer is pretty simple on the Aol side of things: Verizon has deep pockets and will help Aol scale its adtech and media business at a much faster rate. For Verizon, who already spends a substantial amount on advertising with Aol, it’s about streamlining their marketing and accessing Aol’s sophisticated programmatic advertising channels.

From the content side (the blogs, HuffPo, etc) this is sort of strange: there are a lot of companies I might have expected to sell before Aol. So I’m inclined to believe this is mostly about advertising? But I thought web advertising was terrifying and changing all the time. Why would you spend four billion dollars on it?

Yeah. I think the content side of things is more of a byproduct of this deal, rather than the focus. There is already talk of Aol’s brand group (which includes the premium properties like HuffPost and Techcrunch) spinning off. Four billion dollars is a high number, but for a consolidated tech platform for mobile and video, it’s not as ludicrous at it initially sounds. It’s a drop in the bucket for Verizon, especially if they do spin off the premium content side of the business.

I’ve heard you talk about programmatic ads a lot. They’re… like automatically allocated/bid-upon ads?

Programmatic is basically an umbrella term that means automation, and there are different ways brands leverage tech to make the ad buying process more efficient. RTB, data and audience buying are all subsets of what we call programmatic. (Actually Aol pretty recently fired most of their “direct” sales staff to make more room for programmatic specialists.)

“Direct” being like Aol ad humans who would set up deals directly with advertisers or their ad agencies?

That’s right. These are your classic ad sales people who schmooze with clients over drinks. After that ad sales person convinces a brand or media buyer at an agency to sign a contract for, say, $1,000,000, human ad operations people would then manually set up that campaign in their ad server. Then there’s reporting, campaign optimizations, invoicing etc. The whole thing takes a lot of time and energy.

So the programmatic deal is like, you plug your site/content operation into some sort of machine, and instead of shaking hands and talking up your audience, you… pray? Use data? Leverage demographic insights to ensure maximum brand reach?

Programmatic deals all happen over a tech platform that allows the media buyer to decide where their media runs, at what CPM [rate, basically], and for which audience all without the manual processes required in a direct deal.

So the media buyer (person placing the ad) has a sort of big buffet, or like, an interface where they can check various options.

Here’s a simplified version of how it works: Publishers plug into systems called SSPs (supply side platforms) where they, like, package their inventory (by vertical or demo etc). Then buyers access this inventory over DSPs (demand side platforms). You might say “package their inventory into buyable chunks” or “segments.”

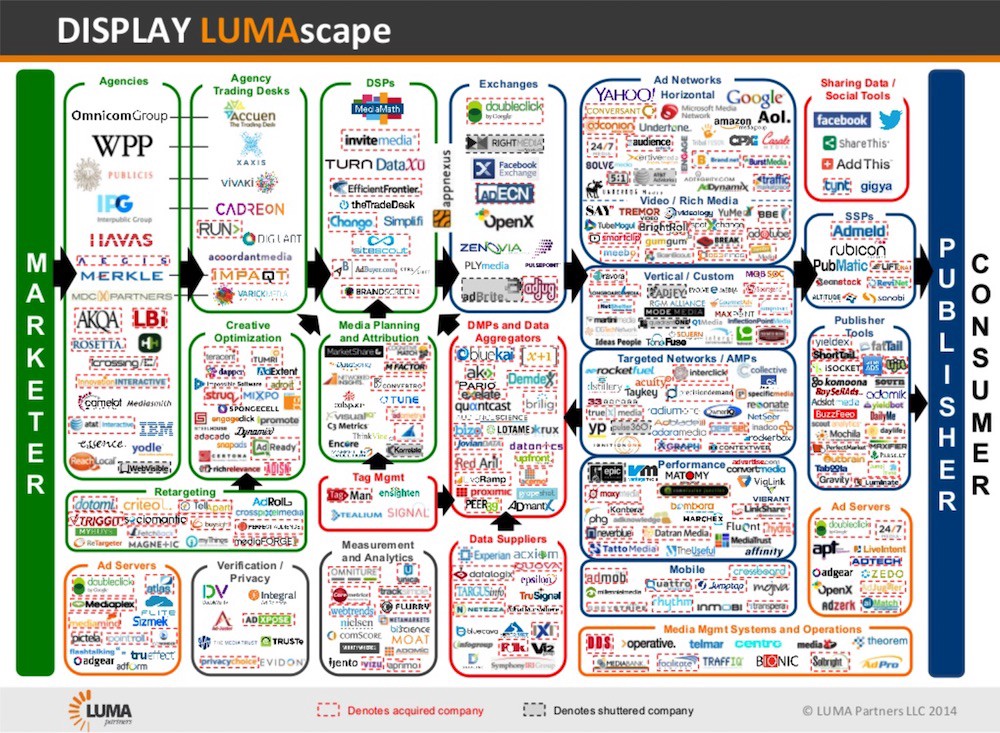

Right, and this is a pretty huge simplification of the dreaded LUMASCAPE world, right? Or is this one more addition?

Haha YES. For those who haven’t seen the LUMASCAPE, it’s an insanely complex graphic that shows all of the technology and intermediaries that stand between advertisers and audiences. These are data providers, ad servers, creative agencies, ad exchanges etc. ANYWAY, Aol is an ad exchange — or a marketplace where buyers and sellers can meet.

This interview is mostly an excuse to embed that photo.

As a publisher, I completely understand. I think the LUMASCAPE should be embedded in every piece of content, regardless of whether it’s relevant.

So Aol’s programmatic exchange is growing, and that’s interesting to a Verizon because programmatic overall is growing. Is there a sense that their style of ad-selling is THE FUTURE of at least some parts of the internet?

Internet ad spend was something like $121 billion in 2014. That’s going to increase as more advertising moves to digital. And programmatic is increasingly the framework in which digital advertising transactions occur.

So who does this matter for? This isn’t Facebook or Google. This is like… sites and site-like things. Or: What is the market for this? Who is now facing down programmatic as this inevitable thing?

It’s not super interesting outside of the adtech sphere. It matters for publishers and advertisers using Aol’s platforms. It’s a confirmation that programmatic matters on a large scale and while this particular merger might surprise some people, the underlying logic isn’t surprising.

So in the future, Verizon hopes, people are selling ads all over the internet through its network, like a big automated centralized clearing house. Or delivering ads in Verizon-world, whatever that means.

Not to mention Verizon now owns a huge marketing distribution wing for their own campaigns. Which they’ll be able to push out for cheaper and at a larger scale. It’s all incredibly boring actually!

Rude. So us, the Awl Network. This is relevant here. We might be selling inventory through VerizAoln.

Yep. Aol Marketplace is actually one of our advertising demand sources. So kind of. Though the effects likely won’t be super significant to us.

Are they the biggest game in town, programmatic-wise?

Aol is big in adtech. But it’s a highly competitive space with a host of major players. There’s Google’s AdX obviously, which is a behemoth. Not to mention AppNexus, OpenX, and more. Microsoft has a pretty sizable ad network, and Yahoo acquired its ad exchange overnight when they purchased Right Media in 2007.

None of those companies are quite a Verizon, though. I guess that’s what seems weird? You hear about consumer web companies buying adtech firms pretty often and you’re like “sure, one more revenue contraption in the web apparatus, whatever.” But Verizon?

Aol differentiated itself by being good at video. They bought 5min Media — then later Adap.tv. When they plugged those into HuffPost’s inventory they became a major force.

From the outside I don’t really get what that means, that they were “exceptionally good at video.” Video from where, seen by whom?

It means they had a TON of people watching video, and a ton of advertiser demand looking to access that audience. And a strong tech platform for connecting the two.

BUT WHAT VIDEO? WHERE?? Like within Aol properties? Or also through advertising arrangements outside?

Any type of video “content” running on websites plugged into the system. With 5min they bought a library of thousands of videos, which could then be distributed across HuffPost in “contextually relevant” articles. These videos could be cooking tips, or short interviews, or DIY tutorials, or more cooking tips.

Oooohhh, so the vast wilds below/near articles.

HuffPost was a major syndication platform, but there were tons of other sites in the network as well. Back in the day, advertisers would often buy tons of pre-roll impressions against video content in specific verticals, without ever knowing where that content ran. For example, 99% of a huge campaign budget might run on just one or two less-than-premium sites — whereas only 1% might show up on a brand name web property, etc. There was not a lot of transparency then, and a lot of video buying still works that way.

It seeeeems like programmatic would, among many many other things, alter those arrangements. Like, you take out a few layers, you remove a few opportunities for, let’s say, euphemistic descriptions of content/readers/placement.

Exactly. In terms of transparency, things may not be so different. However, now that advertisers are buying audiences — they at least “know” that they are targeting their core demo. The point of audience buying is that it’s site agnostic, but the more sites you have plugged in the better. And it still might be the case that a disproportionate amount of video views could come from a handful of sites.

Or from creative ad units on existing sites. One thing: This still feels pretty firmly outside of social platforms. It sounds like a big change for display advertising and video on the web but doesn’t seem like it cracks open the door to any of the huge platforms that publishers (and advertisers) are staring down right now.

That’s right. The type of ads being bought and sold programmatically have largely emerged in parallel to social platforms, not within them. Programmatic channels and social will still compete over ad budgets — especially for video.

So a social media triumphalist might say like… who gives a shit? This is a dead web. Alternatively someone less bullish about the biggest platforms and apps might say, well, this is a separate, less centralized, less contingent thing. (That many companies are attempting to turn into a platform, lol.)

Haha, they might say that! At the end of the day, what really matters is demand. And there is still significant demand for ad products that exist outside of the social realm. And you can still buy Facebook and Twitter through some DSPs. There is always the capacity to integrate those worlds, and some are already making headway.

So either a whole bunch of people use Aol’s programmatic stuff to buy and sell ads, and/or it becomes some sort of revenue thing inside a big mysterious video…. thing, or it evaporates into thin air taking piece of the internet with it.

I think any of those are possibilities.

Ok good.

With Verizon’s money behind the platforms, we can expect AOL’s adtech platforms to wrap its tentacles around more publishers while shoving more advertising demand through…those tentacles.

Nice, nice.

You can edit all of this for clarity.

Nope I think this is very clear, thank you.