Are Twitter, LinkedIn And Facebook Worth Anything?

Are Twitter, LinkedIn And Facebook Worth Anything?

TWC goes to Comcast. This chart helps put it in to perspective. pic.twitter.com/XmlAZvOE3Y

— James Gross (@James_Gross) February 13, 2014

That chart above went around a bit last night, with the news of the purchase of Time Warner by Comcast for $45.2 billion. It compares the “market value” of LinkedIn, Twitter, Facebook and Google v. the “market value” of CBS, Viacom, Disney, Comcast and Time Warner Cable. You know, the new establishment v. those stupid old dinosaurs. Hmm, how else could we compare these companies?

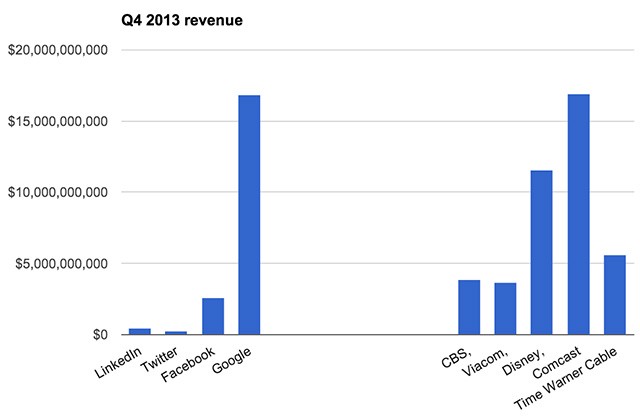

Oh right, how about by that crazy out-of-fashion metric: by the money they make? I made you a chart! Here’s that “Social/Mobile” category on your left and the “Traditional Media” on your right.

And this is Q4 2013 revenue only. Basically, the total revenues of those old dinosaurs ($37.7B) were about double the revenues of the digital/social companies ($20.1B) — and that’s only because Google is included, which is a real business, bringing in a whopping $16.6B of that share. (About as much as Comcast, which is fascinating.) Time Warner made more than LinkedIn, Twitter and Facebook combined.

So yeah. To put the Time Warner-Comcast deal in perspective: THEY HAVE MONSTER BUSINESSES with an ASSLOAD OF MONEY FLYING AROUND.

Mighty Facebook, to its credit, had revenue of $7.87 billion in 2013 all told. Of course, then you realize it’s just an advertising delivery platform. In the fourth quarter, $2.34 billion of their $2.59 billion quarterly revenue was from advertising. It has, essentially, no other business income.

Meanwhile, Comcast had revenue of $64.7 billion in 2013 (and $8.5 billion in free cash flow). So they’re getting Time Warner for like, nine months of their earnings.

Other companies, in comparison, basically don’t even exist. Twitter, for one, had 2013 revenues of $665 million, with a full year net loss of $645 million.