The Great VC Coin Rush: At The Bitcoin Convention

The world-altering monetary miracle and/or freakshow that is Bitcoin was on full display at the Bitcoin 2013 conference in San Jose this May. There were more than a thousand attendees, among them bankers, libertarians, conspiracy theorists, sea-preneurs, developers, scantily clad vodka models, the Winklevoss twins, Internet Archive founder Brewster Kahle, Soft Skull Press founder Sander Hicks, and a large fraction of the world’s Bitcoin experts. Also, in the lobby, roaming gangs of Imperial stormtroopers and superheroes, since there was a comics convention going at the same time.

So is Bitcoin a great invention, or a trainwreck in the making? Maybe!

Because it’s decentralized and no third parties such as banks or governments are required to guarantee transactions, Bitcoin has the potential to be a far safer, more transparent and more reliable medium of exchange than anything that has yet been tried. There is no Ben Bernanke, Mario Draghi or Shinzo Abe for Bitcoin, no way of devaluing it, no way to print more to bail out insolvent banks or buy up mortgages. Plus, Bitcoin could conceivably help to free the world of the skimming machinery of existing banks and payment processing systems. In this way, Bitcoin could be really beneficial for people to use as money. However, the politics of Bitcoin is, not to put too fine a point on it, diverse. Or incalculable, since Bitcoin is an entirely new kind of money.

“Bitcoin is politically neutral,” Gavin Andresen, the Chief Scientist of the Bitcoin Foundation, told me. “People love to put their own political values into it, and see them reflected in the Bitcoin system, and see how Bitcoin will help them achieve their political goals. Well, maybe? But as a technology person, I am actually a little skeptical of the extremes. So I don’t think Bitcoin is going to topple governments; I think governments are going to figure out how to tax it; even if the whole world were using Bitcoin, I think governments would still figure out how to make you pay your taxes.”

This seems certain to me, too. But there are many dueling agendas swarming all around this project, even now. I left the conference uncertain whether the potential benefits of Bitcoin can ever be tapped, because like everything else people invent, its potentialities, however great, are very liable to be swamped by the same lunacy, greed and incompetence that mess up all our other systems.

* * *

Bitcoin enthusiasts can be divided into three rough (and sometimes overlapping) categories:

• Geeks, who are irresistibly drawn to Bitcoin’s elegant and (apparently!) foolproof melding of software and network techniques to create trustworthy, spendable, savable money;

• Politically motivated participants, the motliest crew imaginable, cypherpunks, anarchists, libertarians, leftists and various disenchanted others, united solely in their opposition to the baroquely fucked-up monetary policies of modern nation-states;

• Speculators, who would just as soon be investing in coconut macaroons, if they thought there was a nickel to be got out of it.

This year’s dramatic runup in bitcoin prices — a bit under $120 today, on a fairly stable month-long plateau after a dramatic spike, and up from around $5 at this time last year — has vastly increased participation in the third category. Witness just a sampling of the Bitcoin venture and angel funds and investments announced in recent months: BitAngels, a new angel fund, raised over $12 million; Liberty City Ventures, $15 million; Union Square Ventures invested $5 million in Coinbase, a bitcoin wallet system; a $2 million-plus round for OpenCoin, developers of the new exchange, Ripple, with the participation of Andreesen Horowitz and Google Ventures; Founders Fund led a $2 million round for BitPay, a payment processor (Peter Thiel, who, as you may recall, made quite a lot of his zillions as a co-founder of the payment processor PayPal, is the creator of Founders Fund). None of these is a particularly large raise by Silicon Valley standards, but the total adds up to a significant and broad-based endorsement.

So in the last year, Bitcoin has gone from being a geeky, esoteric little project to become the subject of world news, of interest not only to the “investment community” but also to government regulators, whose involvement will likely alter the Bitcoin landscape in ways not yet foreseen. But all these developments are generally acknowledged among experts in the community to be inevitable preconditions to the wide adoption of Bitcoin.

* * *

Cameron and Tyler Winklevoss of Facebook fame gave the conference’s keynote address. They recently told the Times that they have acquired about one percent of the existing bitcoins — somewhere in the neighborhood of 100,000, or around $12 million at today’s rate of exchange. Separately, it appears, they are also investors in bitinstant, a platform for expediting the transfer of regular money into bitcoin.

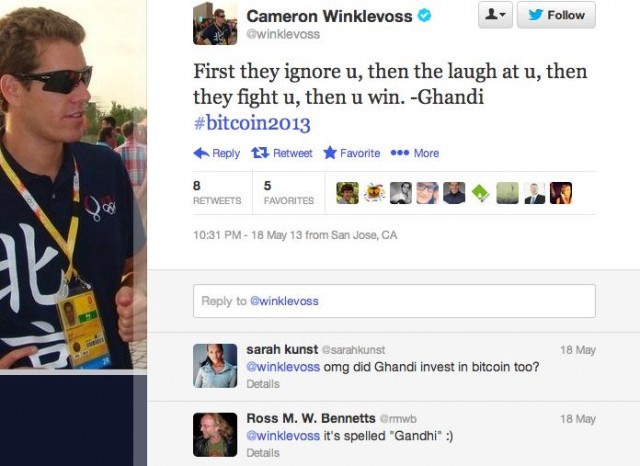

The twins are as big, brawny and self-confident as one had been led to expect. Polished speakers they are not. They opened their PowerPoint with a slogan lifted from a refrigerator magnet they saw somewhere, a slogan often (and almost certainly wrongly) ascribed to former Apple pitchman Mohandas K. Gandhi (or “Ghandi,” in Winklevese):

“This is Ghandi, I hope everybody here knows who Ghandi is,” one of them said, bewilderingly, at the start of a narcoleptic speech entirely free of politics or cryptography, the single message of which was: “We’re a-gonna get rich, boys.”

The eye-popping irony of this opening scene — one of history’s most famous anti-materialists, hauled in with a spurious quote to lend a “socially conscious” or “revolutionary” gloss to the sentiments of the crassest profiteers going — was so poetically deranged that it cast a sort of psychedelic aura around the proceedings that lasted me all three days.

Anyhoo. Bitcoin! The shindig became less and less boring from the keynote onward, I must say. The whole conference generated a buzzing, crackling excitement throughout — the feeling of money about to be made. The crowd seemed to be wandering through a blizzard of business cards. Pin-drop silence for the panels and presentations — there were dozens of them, on alternative cryptocurrencies, regulatory matters, the long-term stability of the Bitcoin system, and so on, all over the map: crazy, or fantastic, or practical-sounding ideas presented by wonks, lunatics, lawyers, visionaries. (A lot of it is already available on YouTube.)

There was also an astrologer offering to divine the compatibility of your chart with that of Bitcoin (silly, really, since nobody knows where Bitcoin was born); a Bitcoin ATM; a screening of the trailer for an upcoming Bitcoin documentary. Lavish, nonstop conference catering buffets. Coffee and muffins, bagels and cookies for breakfast; pasta, salmon, grilled chicken and sirloin tips for lunch; fancy candy and energy bars, popsicles and ice cream in the afternoon; later, free booze, and the aforesaid vodka babes in hotpants and sky-high platforms dispensing their wares. Guys shaking hands, guys muttering excitedly on the phone, fielding pocketfuls of business cards, texting like mad.

And I do mean “guys.” Some 95% of those in attendance were men. The gender disparity made itself felt in a number of ways.

Several times, a familiar, catchy song filled the main hall: Swedish House Mafia’s “Don’t You Worry Child” — but with lyrics, I was enchanted to realize, about Bitcoin (!). “Just when the Cypriots were losing faith/That’s when I learned about the blockchain […] Satoshi said/Don’t you worry don’t you worry child/Bitcoin has got a plan for you.” This was a “Zhou Tonged” song, and is easily outrunning a fusillade of takedown notices on YouTube and elsewhere. (The story of Zhou Tong is a long one, and wild.)

* * *

The venture crew arrived in San Jose with loafers freshly shined, counseling cooperation with the government agencies who have taken a sudden interest in Bitcoin this year, issuing new guidance for MSBs (“money services businesses”), and throwing a regulatory spanner in the works of Mt. Gox, currently the largest Bitcoin exchange. The good-boy attitude of the investor class sometimes doesn’t sit too well with the largely libertarian contingent that started the ball rolling for Bitcoin in its early days.

So far as the Feds are concerned, the recent takedown of private digital currency Liberty Reserve has frequently, and wrongly, been associated with cryptocurrencies such as Bitcoin. Run by “a former U.S. citizen and naturalized Costa Rican of Ukrainian origin” named Arthur Budovsky (he was pinched in Spain), Liberty Reserve currency wasn’t decentralized the way Bitcoin is, but was instead issued by the company itself, like a kind of scrip or IOU for dollars, gold or euros; a medium of exchange particularly suited to money laundering. Maybe this is my imagination failing me, but I can’t think of a good reason to pay to exchange regular currency for Liberty Reserve (or more to the point, to assume the substantial risks associated with entrusting money to Liberty Reserve itself, the sole authority over the currency) absent the need for total anonymity. The Liberty Reserve fiasco has, however, added another frisson to the ongoing regulatory nervousness around Bitcoin.

Libertarians, as I was after saying, generally dominated the Bitcoin conference; there was a lot of talk about the Free State Project, Ludwig von Mises (ho hum), and taxes. As you may have heard, these libertarians do not want to pay any taxes ever, because that is the perfect form of government. And if you are wondering how come no civilization in history ever managed to implement the perfect tax-free government before, that is just because you are an ignoramus who hasn’t heard of medieval Iceland. (Never you mind about Colorado Springs, several hundred of whose undertaxed residents, lacking an adequate fire department, lost their houses in a blaze of tax-free glory!)

Anyway, one libertarian group at the conference, whose attempt to found their own tax-free, “business-friendly” “country within a country” in Honduras was peskily foiled by Honduran citizens when they got wind of it, presented the news that they are making a new deal in an as-yet-unnamed country (waiting until the ink is dry, I guess). Then there is a group of seasteading types who are founding a business sea-cubator on a boat twelve miles from Silicon Valley (“outside the jurisdiction of the United States”) where they can hire all the cheap, H-1B-visa-less Chinese and Indian engineers they please. (Freedom!) For this purpose, they have already chartered the MS Island Escape. (Later I told my husband that this part of the show sounded like a giant Michael Crichton plot generator.)

Meanwhile, Internet Hall of Famer Brewster Kahle, freedom of information activist, co-founder of Alexa and founder and director of the Internet Archive (and the Wayback Machine), where employees may already elect to receive part of their salaries in bitcoin, is founding an Internet Credit Union: a splendid idea.

The roaring success of the M-Pesa system, a cellphone-based money transfer service founded in Kenya by Safaricom in 2007 and since exported to various African countries, India and Afghanistan, has not gone unnoticed by Bitcoin entrepreneurs. Many billions of the world’s “unbanked” people (a) have cellphones and (b) live in countries where fiscal corruption is rampant. Bitcoin is already easy to trade by phone using existing technologies outside the banking system, and despite some very wild blips in the exchange rate against USD and Euros, Bitcoin is actually more stable than a number of existing fiat currencies. It’s logical to suppose that countries whose banking systems and native currencies are the least stable are the most natural markets for the adoption of Bitcoin. There appears to be a ton of entrepreneurial activity in this area.

There’s so much more, I can barely scratch the surface. Such as, the highly credible analysis indicating that nearly 10% of the world’s Bitcoins have been stashed and never spent by Satoshi Nakamoto, Bitcoin’s mysterious founder(s) (worth maybe $150 million at today’s rates). Or the stream of wild-eyed grad students who interrogated Erik Voorhees of SatoshiDice and bitinstant after his presentation, especially the guy who asked him about “the teleos of Christ.” Voorhees is this geekily elegant libertarian who waxed all rhapsodic about Bitcoin and how terrible governments are, etc. (He totally fooled me for a second by claiming to be a democrat, so deadpan is he.)

The libertarian, I have come to find, is naive in his own special way: for example, Voorhees said, “I trust profit seekers more than I do a politician, I think the incentives are better.” Oh, LOLs. They get fed up with those guys on the online Bitcoin Forum, too (much the best place, by the way, to learn about Bitcoin): “Oh spare me the libertarian bible thumping.”

* * *

After the conference, I was tempted to characterize the Winklevoss speech as the paradigm of Bitcoinmania as it currently stands: a good idea, maybe even a great one, in the process of being misunderstood and misappropriated — perhaps fatally so — by a gang of clueless would-be plutocrats for their own ends. And yet. Experts and leaders in the Bitcoin community appear to be entirely unfazed by these and other dodgy-looking recent developments. They have placed their trust in the original design of Bitcoin, which they believe will be resilient enough to withstand whatever governments, ideologues and rent-seeking entrepreneurs can throw at it.

It is troubling — to me, at any rate — that Bitcoin is so widely seen as a path to personal wealth rather than a path to global economic fairness. A lot of Bitcoin entrepreneurs will tell you that it’s possible, and healthy, to seek those goals simultaneously; but it’s very easy to see which imperatives will prevail, should a conflict emerge.

I asked a number of people about this, and they all answered roughly the same way. But Mike Caldwell of Casascius — manufacturer of physical embodiments of Bitcoins! — put it best, I thought:

“The price of Bitcoins may go down if people break laws, if bad things happen. I don’t plan on breaking any laws, though, and I would certainly hope that regardless of what other people choose to do — break the law or go against the interest of the government that they live in — perhaps they’ll be held accountable for their own actions. And those of us who just want to use it to promote liberty and privacy can continue to do that, and not be bothered.”

Maria Bustillos is a Los Angeles-based journalist and critic.