Our Debt: Why Rich People Should Be Worried Too

by Carl Hegelman

Back in the days before the great bull market began to charge in August of 1982, there was a soothsayer called Joe Granville. He was the Mad Money Jim Cramer of his day, a showman and exhibitionist whose performances included walking on water (across a swimming pool in Tucson, dressed in a tuxedo) and a piano-playing chimp. Despite that his demeanor wasn’t what you would expect of a great financial brain, he attracted a large following of investors for his $250-a-year financial letter (about $615 in today’s money), partly because, as People magazine explained, he had called four major stock-market turns in two years. His reputation grew to the point that when he issued a “sell everything” fax to his premium subscribers in January 1981 the market dropped 2½% on its busiest trading day to that point in history.

For every big financial turn, there’s at least one hero who saw it coming. It’s not surprising, when you think about it. Given the number of promoters airing their opinions, it would be surprising if someone, somewhere, hadn’t called it, maybe even three or four times in a row. It’s like the monkeys with the typewriters. The surprising thing isn’t the occasional masterpiece. It’s when the same lucky monkey who wrote Taming Of The Shrew then proceeds to peck out Two Gentlemen of Verona and Love’s Labour’s Lost. And, sure enough, Joe Granville’s reputation didn’t survive the Great Bull. Apparently, he’s still in business, but I read somewhere that over the past 25 years his recommendations have lost an average of 20% a year. No word on his piano-playing chimp.

There are various heroes for the financial crunch of 2008–10; such as Robert Shiller of Yale, who called both the dotcom and the housing crashes, and Meredith Whitney, the banking analyst formerly at Oppenheimer who first exclaimed, in October 2007, that Citigroup was wearing no clothes (and who, by the way, is now predicting a meltdown in the municipal bond market). Perennial doomsayer Nouriel Roubini of NYU is also often cited, although he was already something of a stopped clock by 2008, more focused on the trade deficit with China than on the exponential rise of house prices.

Lately, the economic duo of Kenneth Rogoff and Carmen Reinhart have become talk-worthy because of a series of studies of past financial crises focusing on the dire consequences of having too much debt. Their most recent paper on “The Aftermath of Financial Crises” caused a stir because it’s telling us that running up bigger deficits will only prolong the problem, a prescription that goes against the current policy of deficit-financing backed by both political parties — whatever they may say to the contrary — in the recent tax-cut-extension act. Probably nobody disagrees with Rogoff and Reinhart that our debt is a problem, but how big a problem is it and why is it a problem?

Well, if you add up $14.5 trillion in mortgage debt, $14 trillion of national debt (Treasury bills and bonds), $2.5 trillion in consumer debt (credit cards, student loans, car loans, etc.) and $3 trillion in state and municipal debt, you get to around $34 trillion. Given that we have about 140 million people working right now, that works out to about $240,000 for every working stiff in the country.

The median household (about 2.5 people) in the US has an income of around $52,000 a year, and that’s including things like unemployment and Social Security benefits.

To pay back $240,000 at five percent over thirty years would cost this hapless worker about $1,300 a month or $15,500 a year. Obviously, that doesn’t leave much for spending on stuff. Which in turn means companies don’t make as much stuff and don’t need to hire as many people, which means fewer paychecks, which means… the debt makes it much more difficult to pull out of the slump.

According to Rogoff and Reinhart, unemployment rises by seven percentage points after your average financial crisis — we’re at about five so far — and the employment down-cycle lasts more than four years. House prices go down 35% over six years and stock markets go down 55% over three and a half years. Per capita real GDP goes down 9% over almost two years (ours went down about 4% and has just recovered to the level it reached in the fourth quarter of 2007). These are all average numbers for post-WWII crises. During the Depression, the United State’s GDP per capita went down a lot more — almost 30% — and bottomed out after four years. And because tax revenues go down when nobody has a job, government debt goes up — by an average of 86%. Which, of course, makes it that much harder for the economy to climb out of the swamp. Since March 2008, the government’s debt has so far increased about 49% — and it’s still climbing quite rapidly.

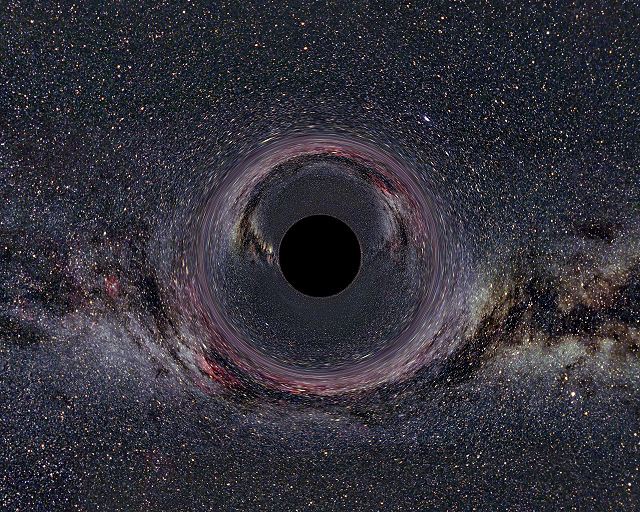

But one of the most interesting questions — and one that doesn’t seem to get much emphasis in the media — is, to whom exactly do we owe all this debt? We talk about “the debt” almost as if it were a kind of mythic Black Hole into which indentured humanity will have to pitch income forevermore, yet the debt must be owed to somebody. So who? Who are the blighters seated at the other end? Aliens?

To listen to the pols you’d think, indeed, we owe it all to the Chinese, who will therefore shortly become our lords and masters. Actually, that’s not really true; it’s just a convenient diversion. John Boehner, for example, recently attacked the debt-mongering (while ignoring that it’s mostly due to Bush tax cuts and Bush wars) by declaring that it was “immoral to rob our children’s future and make them beholden to China.” Truth is, this makes about as much sense as him pronouncing his name “Baner.” In Treasuries, for instance, our total debt to China is about $1.1 trillion. It’s not nothing, and there’s likely other debt than Treasuries, but in the whole $34 trillion scheme of things it’s clearly not the main problem.

The fact is, we owe most of this $34 trillion to our real lords and masters, viz., rich people. That is, John Boehner’s campaign-funders; hence the China diversion. It stands to reason, really. The debt built up because for decades our working stiff has been spending more than he makes. He was only able to do that because rich people were willing to lend him the money, which they did because (a) they have, literally, more money than they can spend; and (b) they needed to keep the economy humming along and so preserve the value of their investments. There’s a little bit more to it than that, which has partly to do with the magical ability of banks (N.B., owned by rich guys) to create money, but the essence is there: only people who don’t spend all their income, by definition, can lend money, so who the hell else would we be owing all that money to?

Now you can see why our economic system is prone to periodic crises. If rich guys take too much of the national income, year after year, the economy can’t sustain itself and eventually collapses. That’s maybe one reason why the countries with the highest income inequalities are often the poorest. In terms of the “Gini coefficient,” a measure of income inequality, the US ranks in the worst 30% in the world, right between Jamaica and Cameroon, and with greater inequality than such countries as Tunisia, Egypt and Libya.

In other words, income inequality is, in the long run, a recipe for economic disaster. And economic disaster isn’t good for anyone — not even rich guys. It might, for example, do the wealthy well to remember that, between 1928 and 1933, the number of millionaires in the US went from around 30,000 to around 5,000 (see Kevin Phillips, Wealth & Democracy). You can only suck so much blood before the victim dies, and then what are you going to do for food?

Clearly, what we need for our long-term economic health is a system that allocates income more equally. Theoretically, it would be possible to do this without taxation, by giving wage slaves a bigger share of the pie. But that would mean lowering executive pay and/or corporate profits, measures that probably won’t be accepted voluntarily. So we’re left with taxation. The fact is, it’s in the best interest of all Americans, including the high rollers, to raise the tax rate on the upper-income tiers. Taxing the rich isn’t just morally fair, it’s good for the economy. The more grounded and rational rich guys, like Warren Buffett and, recently, Bill Gross of Pimco, recognize this; but the current in Washington is clearly with the delusional fringe that thinks lowering taxes on the rich promotes growth. After all, worked pretty well so far; right, George?

The fact is, the economy will come back into balance at some point, either through defaults (which will result in rich guy creditors being no longer so rich), inflation (likewise) or a long and grinding repayment of the debt (rich guy stockholders no longer so rich). One way or the other, the rich-guy creditor-stockholder is going to take his drubbing. With little prospect of getting the rich-guy tax rate up near term, it looks like we’re going to have to do it the hard way. Forsooth!

Carl Hegelman (a pen name) is a corporate bond analyst and a connoisseur of leisure.

Image courtesy of the Gallery of Space Time Travel, via Wikimedia Commons.