Goldman Sachs Banks Report: "Are We 'Turning Japanese'"?

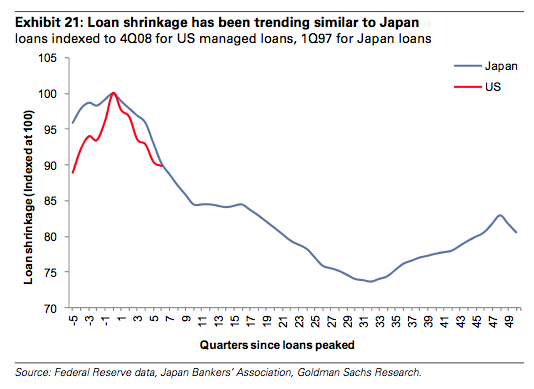

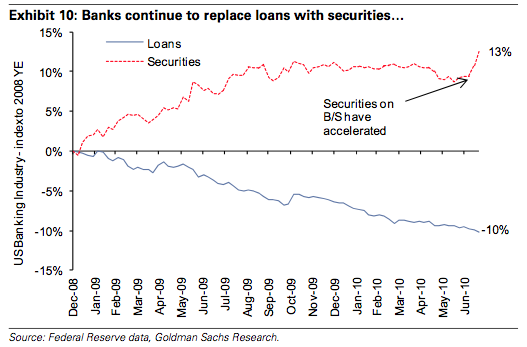

Today’s Goldman Sachs report on the U.S. banking industry has an amusing section where they have quite a number of graphs to prove that we’re not going to end up like Japan. They write: “The collapse of an enormous asset bubble, a banking and credit crisis, zero interest rates, central bank balance sheet expansion, and massive fiscal stimulus have caused some people to question whether the scenario here could continue to play out like Japan, where loans declined for eight years after the peak and interest rates remained near zero.” Loan shrinkage has indeed been trending just like Japan-but the U.S. cut interest rates and addressed a looming crisis much faster than Japan did. But what are banks doing now? They’re favoring securities over loans.

While very slight year-over-year growth in loans is expected to resume in 2011, loans have recently dipped and stuttered hard.

And while banks were making money off securities-”cash was swapped into securities at a very similar yield” as loans-now that party train is over. “As a result, as bank security portfolios continue to mature, banks are faced with the decision of buying expensive short-term assets or taking significant interest rate or duration risk given the lack of lending opportunities.” Oh yes, the “lack” of lending opportunities. That’s it.