Notes from an FX Trader: On Genius, Idiocy and the Merely Intelligent

by The Green Manalishi

“An intelligent person will only make money from other intelligent people. But a true genius will make a fortune off all kinds of idiots.” -Dr. Frederick C. Evering

When Dr. Evering first articulated his Theory of Genius and Idiocy (TOGAI, I guess), Steve Jobs, Rupert Murdoch and Oprah Winfrey had only just begun establishing spaces in the socio-culturescape; Reality TV was just emerging from the womb in the form of MTV’s “Real World”; and the letter-word combo “P-Diddy” was nothing more than shorthand for “I have to take a piss” to those either barely out of the crib or legitimately speech-afflicted. The year was 1993, and what was on Dr. Evering’s mind was the new Dodge Intrepid he had just bought, fully tricked out with neon undercarriage, heated seats and Knight Rider-esque voice reminders to close the door and switch off the lights.

He soon realized such extras were hardly worth the expense, hence the TOGAI epiphany. From my 19-year old standpoint, I was amused by an elderly scholar, a man who liked to remind us that he had “been teaching Electrical Engineering since the Eisenhower administration,” openly implying that he was unsure of whether to consider himself intelligent or an idiot (that he did not qualify as a genius according to his theory goes without saying).

For sure, the Intrepid provided ample fodder for his inevitable trips off-topic both in and out of class and what Dr. Evering-my sophomore year EE101 professor-liked more than anything was getting off the stoic topic of electrical network analysis and on to the far more compelling topic of life. So I dropped by during his office hours one afternoon to see where next he could go with intelligence, genius, idiocy and the fiduciary relationships binding them together.

“Ever heard of George Soros?” he asked, when I explained why I came by. I shook my head. Dr. Evering explained how Soros had made out with a fortune shorting the British pound the year before, thereby forcing the Bank of England to abandon the European Exchange Rate Mechanism (the precursor to the euro); Dr. Evering then proceeded to compare the whole ordeal wrought upon early 90s British monetary policy to a voltage drop in an electrical circuit-as only a professor who had been teaching Electrical Engineering since the Eisenhower administration could.

“So if Soros was the genius, who were the idiots?” I asked.

“Well, the Establishment economists who thought this whole contraption could work, of course,” I remember him saying. “And I suppose the politicians for buying into it.” And then he added, as he was prone to do, an extra jab of why-does-this-matter commentary: “That’s the difference between us engineers and the rest of ‘em, you know. You can’t just wish something to work. It either works or it doesn’t. And whichever the case may be, there’s a reason.”

Sorry, quick non sequitur since this is in front of me as I write-the next person I hear utter the phrase, “doing well by doing good,” I swear I’m gonna take a steaming hot rusty rabies-infested poker and shove it straight up their rear until it comes out of their mouth. Okay, it’s time to turn off the TV.

Right. Anyway, seventeen years later, as I sit here in front of my laptop bobbing and weaving through the FX markets, more and more items come up that make me wonder what Dr. Evering would make of all this.

I want to make clear first that I’m not intending to turn this into some advice-guru-prediction-pissing contest thing. There just seem to be an increasing number of conflicting things bumping around the EURUSD trade lately. Among the simpler ones (this being a family-oriented blog and all), is that during the week preceding July 4, both the US stock market AND the US dollar tanked, because, apparently, nobody wanted to spend July 4 thinking about uncovered positions in anything but US Treasuries (“risk-off”, if you care to sound current). What’s most interesting about this is that for the first time since I don’t know when, the US stock market and the dollar actually moved in the same direction.

Here’s another: since the euro came back to its life-to-date halfway point on June 4, all those supposedly evil hedge funds that were supposedly pulling a Soros 2.0 on the Eurozone all of a sudden flooded the airwaves claiming the big short was over. Moody’s warns on Spain? Meh-price is already baked in, they said. Next came Robert Mundell, winner of the Nobel prize for Economics, and one of the architects of the euro, claiming that (surprise, surprise!) the euro was oversold. Next came Nouriel Roubini, likely future winner of the Nobel prize for Economics, directly contradicting Mundell by saying he “could see the euro falling to parity with the dollar.”

Who’s the genius here and who are the idiots?

And then there’s the Schumer-China kabuki show, which has been resurrected once again, and which awlsome had the presence of mind to ask about on my last contribution here. About every nine months or so, Charles Schumer decides he’s going to make noise about China’s exchange rate regime, arguing that the peg its currency, the yuan, has with the US dollar is detrimental to American jobs, or is the reason the US economy is in the toilet, or some such nonsense.

Generally, politicians-particularly compromised Banking Committee senators-don’t move markets. The People’s Bank of China, on the other hand, is a modern day EF Hutton, even when it issues a statement as vague as what it released the weekend of June 19. If you don’t come up with any conclusions from reading it, don’t worry, you’re not alone. Nevertheless, markets responded by immediately driving the euro up nearly one percent against the dollar, followed by a prompt sell-off once everyone realized that what Chinese authorities mean with the word “flexibility” is not necessarily the meaning that best serves Western purposes (duh!).

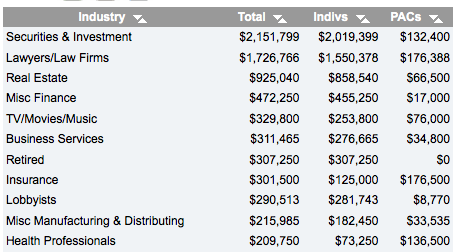

Schumer sounds like the idiot on China’s currency issue, but hang on-let’s remember a couple of things. Schumer is no stranger to Wall Street campaign contributions. Would Wall Street banks benefit from looser controls on the yuan? Of course. Can Wall Street banks openly call on Chinese authorities to loosen up the yuan’s peg to the dollar? Of course not. Would we be surprised if there’s a tacit agreement between Chucky S. and certain campaign contributors of his to do their bidding for them? I think not. So in this Schumer-Wall Street-China triangle, who’s the genius and who are the idiots?

Because he wants to work making money with other people’s money, obviously our currency-trading friend would prefer not to publish under his real name.