How the 'New York Times' Can Barely Cut Costs Fast Enough To Survive

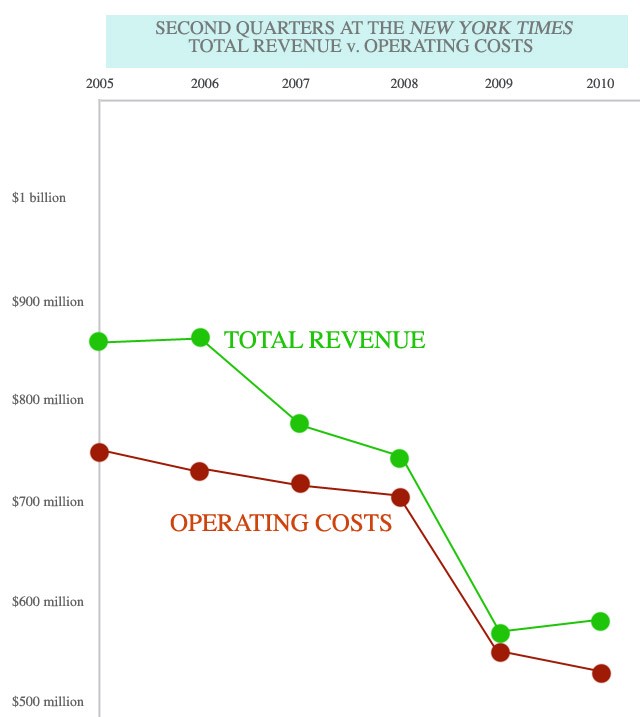

Today the New York Times published a story about its parent company: “Times Co. Posts Operating Profit Gain”! Well, that’s… true. (And they mean the second quarter of this year over the second quarter of last year.) But, once again, it’s historical context time! If you look back over the last five years, what you see is the newspaper radically chopping its operating costs.

One way to do that is by firing people! And by making your paper smaller. But you have to be careful how many people you fire and how small you make the paper, because you still have to keep people interested in your product.

This shows how over the last five years, not only has the newspaper cut its operating costs, but also it began to lose the margin between its costs and its total revenue.

The second quarter of 2009 was a squeaker-while overall revenue was $584.5 million, the paper’s operating costs were $561.2 million.

How low can those costs trend while still having, like, newsprint and writers? We’ll find out!

I do think it’s also important to say that this is a very big business! And this is all a great deal of money! This is just so we can all look at the numbers-it isn’t intended to say that the Times is necessarily on death’s door.

It is, however, a radical thing to reduce costs by hundreds of millions of dollars over five years-particularly when your revenue is chasing that number.

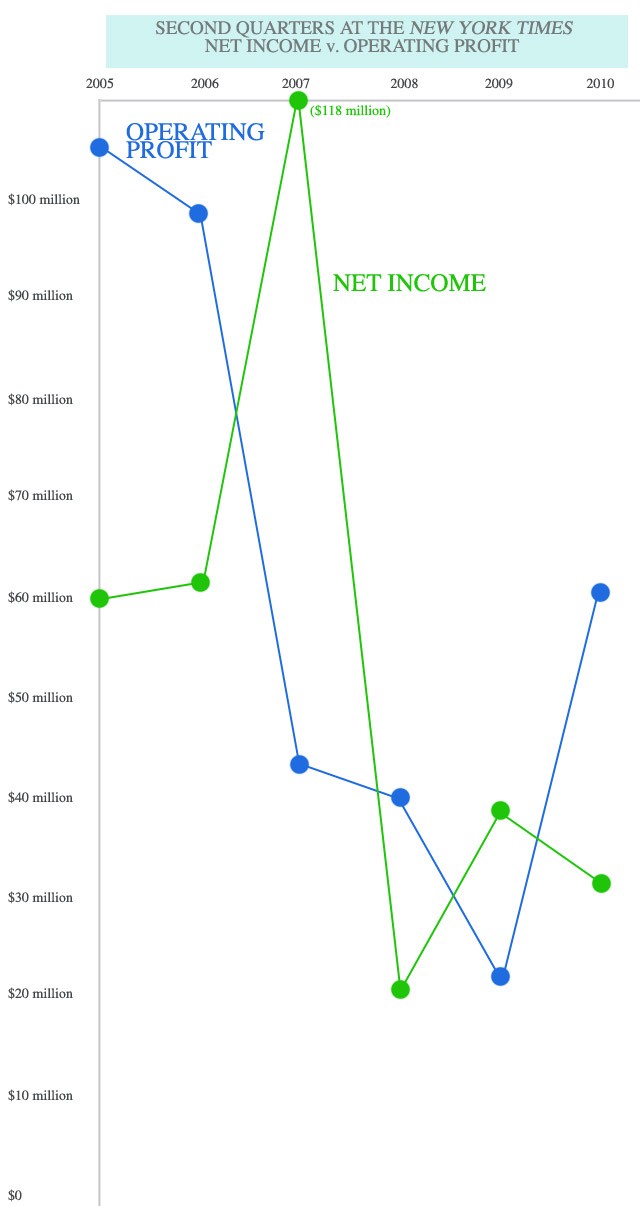

Now. Nerds may carry on here! The point being, the Times was forced to trumpet their “operating profit”-because net income was actually down over last year, and was less than a third of 2007’s net income. (Though it was up from 2008!)

(Non-nerds may wish to be reminded that “net income” is income after subtracting all expenses and losses and “operating profit” is earnings before taxes and interest.)

So you know, they’re both pretty far down over five years.

The last sentence of the Times’ story: “The company reported that it had $102 million in cash on hand at the end of the quarter and net debt of $670 million. “

For more answers, I refer you to their circulation figures.